All Categories

Featured

Table of Contents

Guaranteed global life, like whole life, does not run out as long as you buy a policy that covers the remainder of your life (final expense florida). You can buy a policy that will certainly cover you to age 121 for optimal defense, or to age 100, or to a younger age if you're attempting to conserve cash and do not require protection after, claim, age 90

Anything. An insured might have meant that it be made use of to pay for points like a funeral, blossoms, medical expenses, or assisted living facility expenses. Nevertheless, the cash will certainly belong to the beneficiary, that can choose to use it for something else, such as charge card debt or a savings.

For an assured approval policy, they would certainly pay $51. A 65 year-old man looking for a $10,000 face quantity and no waiting duration may pay regarding $54 per month, and $66 for assured acceptance.

Funeral Cover For Old Age

If you have adequate cash set aside to cover the costs that must be satisfied after you pass away, then you do not need it. If you don't have cash for these and various other connected expenses, or routine insurance that could cover help them, last expense insurance coverage might be an actual advantage to your family.

It can be utilized to spend for the different, traditional services they wish to have, such as a funeral service or memorial solution. Financial expenditure insurance is easy to get and budget-friendly - buying burial insurance for parents. Insurance coverage amounts range from $2,000 as much as $35,000. It isn't a substantial amount however the advantage can be a blessing for member of the family without the monetary wherewithal to meet the expenditures related to your passing away.

While numerous life insurance policy items require a medical exam, last expense insurance does not. When requesting final expense insurance policy, all you need to do is respond to numerous concerns concerning your health and wellness. 2 With final expenditure insurance, costs are secured in once you get authorized. 3 They'll never ever boost as long as your plan remains active.

Burial Policy Insurance

This means that a particular quantity of time need to pass before benefits are paid out. If you're older and not in the most effective wellness, you may observe greater premiums for final expense insurance. You may be able to find more cost effective protection with one more kind of plan. Before you commit to a final expense insurance coverage, think about these aspects: Are you just seeking to cover your funeral and funeral costs? Do you wish to leave your liked ones with some cash to pay for end-of-life costs? If so, final cost insurance coverage is likely an excellent fit.

If you 'd such as adequate coverage without damaging the financial institution, last cost insurance coverage may be rewarding. In this case, it may be smart to take into consideration final expenditure insurance coverage.

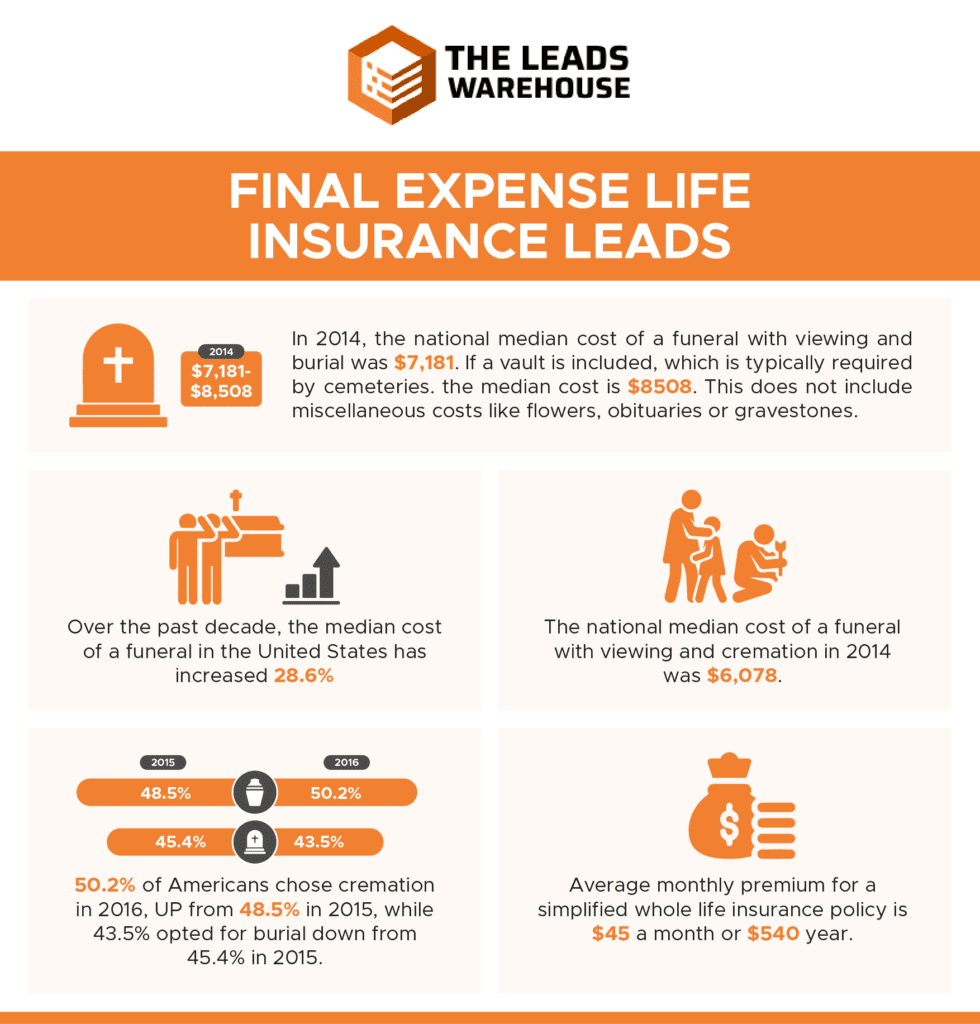

Final costs are the costs your household spends for your interment or cremation, and for various other things you may desire back then, like an event to celebrate your life. Although considering last expenses can be hard, understanding what they set you back and seeing to it you have a life insurance policy policy big sufficient to cover them can assist spare your family an expenditure they might not have the ability to afford

One option is Funeral Preplanning Insurance policy which enables you select funeral products and solutions, and money them with the acquisition of an insurance policy. Another choice is Last Expense Insurance Policy.

American Memorial Funeral Insurance

It is forecasted that in 2023, 34.5 percent of family members will certainly choose funeral and a greater percentage of households, 60.5 percent, will pick cremation1 (choice mutual final expense). It's approximated that by 2045 81.4 percent of families will certainly pick cremation2. One reason cremation is coming to be extra popular is that can be less costly than burial

Relying on what your or your household want, things like funeral stories, grave pens or headstones, and caskets can increase the cost. There may additionally be costs along with the ones specifically for funeral or cremation. They might consist of: Treatment the price of traveling for family and liked ones so they can go to a service Catered meals and other expenses for an event of your life after the solution Purchase of special attire for the service When you have a great idea what your last costs will certainly be, you can assist prepare for them with the right insurance coverage.

They are usually issued to candidates with several health conditions or if the applicant is taking certain prescriptions. final expense insurance agents. If the insured passes during this duration, the beneficiary will normally obtain all of the costs paid right into the plan plus a tiny added percent. Another last expenditure alternative used by some life insurance policy firms are 10-year or 20-year plans that offer applicants the option of paying their policy completely within a particular period

Nationwide Funeral Plans

The most important point you can do is respond to inquiries honestly when obtaining end-of-life insurance coverage. Anything you keep or hide can create your advantage to be refuted when your household needs it most (best burial plans). Some people assume that since many final expenditure policies do not require a medical examination they can lie regarding their health and the insurance provider will certainly never ever know

Share your final desires with them as well (what flowers you might desire, what flows you want checked out, tunes you desire played, etc). Recording these in advance will save your liked ones a lot of stress and anxiety and will certainly avoid them from trying to think what you desired. Funeral costs are climbing constantly and your health could alter suddenly as you get older.

The primary beneficiary obtains 100% of the death benefit when the insured passes away. If the key beneficiary passes prior to the insured, the contingent obtains the benefit.

Burial Insurance Vs Life Insurance

It's vital to occasionally evaluate your recipient information to make certain it's current. Always notify your life insurance policy company of any adjustment of address or phone number so they can upgrade their records.

The fatality benefit is paid to the key recipient once the case is approved. It depends on the insurance company.

If you do any type of kind of funeral planning ahead of time, you can record your final want your main recipient and show how much of the plan advantage you desire to go towards final arrangements. funeral insurance no medical exam. The procedure is generally the very same at every age. The majority of insurance provider call for a private be at the very least 30 days of age to obtain life insurance policy

Some firms can take weeks or months to pay the plan benefit. Others, like Lincoln Heritage, pay authorized insurance claims in 24 hours. It's hard to state what the typical costs will be. Your insurance coverage rate relies on your wellness, age, sex, and how much insurance coverage you're taking out. An excellent price quote is anywhere from $40-$60 a month for a $5,000 $10,000 plan.

Table of Contents

Latest Posts

Assured For Life Funeral Plan

Funeral Protection

Cheapest Final Expense Insurance

More

Latest Posts

Assured For Life Funeral Plan

Funeral Protection

Cheapest Final Expense Insurance